Navigating the Complex Landscape of Clean Energy Incentives to Maximize Savings and Sustainability in 2025

If you’re seriously considering investing in clean energy in 2025, you’re likely overwhelmed by the maze of federal and state incentives—each with intricate eligibility rules, deadlines, and complex tax structures. This confusion can leave you uncertain about which programs deliver real value or where to even begin.

At Vecharged, we recognize that taking advantage of these incentives isn’t just about saving money—it’s about forging a path toward energy independence, slashing carbon footprints, and future-proofing your home or business. This article is your definitive, expert-led guide through the complex ecosystem of the 2025 clean energy incentives, including the Inflation Reduction Act (IRA), Section 45X credits, and vital state-level programs. Our goal: clarity, precision, and actionable insight that empowers you to make the smartest clean energy investments.

Decoding the Federal Clean Energy Powerhouses

Inflation Reduction Act (IRA): The Cornerstone of 2025 Incentives

The IRA is the most consequential legislative push for clean energy in decades. It offers game-changing tax credits and grants that cover everything from residential solar installations to advanced industrial clean energy projects.

- Residential Clean Energy Credit grants you up to 30% credit on solar panels, battery storage, and other renewable tech.

- For commercial and industrial players, the IRA provides accelerated depreciation alongside enhanced investment tax credits, reducing upfront capital needs.

- The IRA also finances a vast array of energy efficiency grants, targeting upgrades in buildings and transportation sectors.

The Vecharged Expert Take:

Think of the IRA as an investment amplifier. Much like upgrading to a high-flow water hose, expanding your renewable systems under this law boosts output and savings exponentially. Installing solar is no longer just a feel-good choice—it’s a strategic financial move.

Section 45X: Fueling America’s Clean Tech Manufacturing Boom

Section 45X is the under-the-radar powerhouse driving domestic manufacturing of clean energy components, a critical piece in establishing resilient supply chains away from overseas dependencies.

- Clean Hydrogen Production Credit: Provides substantial incentives for low-carbon hydrogen fuels, a growing pillar of the energy transition.

- Advanced Energy Project Credits: Targets producers of solar panels, batteries, wind turbines, and beyond.

- Carbon Capture and Storage (CCS) Credit: Pushes industries to deploy cutting-edge carbon capture, reducing their environmental impact and earning tax rewards.

What This Actually Means:

If IRA is about using clean energy, 45X is about building America’s clean energy future. It creates jobs, stabilizes supply chains, and ensures long-term sustainability—and it pays dividends for manufacturers and project investors alike.

State-Level Incentives: Local Boosts That Stack Up Big

Federal incentives are powerful, but many states double down with aggressively tailored programs to fit their unique energy landscapes. Layering these with federal credits can amplify your financial benefits.

- California Solar Initiative: One of the most generous rebate programs, significantly reducing solar panel installation costs.

- New York Clean Energy Fund: Provides grants and incentives focused on renewable energy, energy storage, and efficiency upgrades.

- Texas Property Tax Exemptions: Slashes property taxes on renewable equipment installations, lowering ongoing costs.

The Vecharged Expert Take:

It’s like combining a turbocharger (federal credits) with a nitrous boost (state incentives). Together, they deliver maximum acceleration for your clean energy investment returns.

How to Maximize Your 2025 Incentive Windfall

- Stack Benefits Smartly: Combine federal tax credits with state rebates to maximize savings.

- Know Your Deadlines and Eligibility: Incentives often have expiration dates or technology-specific requirements—missing these can cost you big.

- Expand Your Clean Energy Toolkit: Incorporate energy storage or EV charging infrastructure to qualify for additional credits.

- Leverage Professional Expertise: Navigating these programs can be tricky; tax advisors and clean energy specialists can ensure you optimize all opportunities.

Unique Value Asset Suggestion

Interactive Clean Energy Incentive Calculator:

A dynamic, easy-to-use online tool where users input their location, project type (residential, commercial, manufacturing), and system size to instantly calculate combined federal and state incentive values. The tool would provide tailored savings estimates and timeline alerts for deadlines and eligibility benchmarks.

Why It’s Essential:

This calculator empowers readers to make data-driven decisions, cutting through the complexity with personalized, real-time insights. It transforms abstract incentives into tangible dollar amounts, making investment benefits clear and motivating action.

Your Questions, Answered

What is included in the 2025 Inflation Reduction Act clean energy incentives?

The IRA provides up to 30% tax credits for residential solar and battery installations, credits for commercial renewable projects, and funding for energy efficiency grants.

How does Section 45X benefit renewable energy manufacturing?

Section 45X offers targeted tax credits for clean hydrogen production, solar panel and battery manufacturing, and carbon capture technologies, boosting domestic supply chains.

Can federal and state clean energy incentives be combined?

Yes, in most cases, you can stack federal tax credits with state rebates and incentives, significantly increasing your overall savings.

What are common eligibility requirements for these incentives?

Requirements typically include using certified technology, meeting system size thresholds, and adhering to installation timelines. Each program has specific rules to review carefully.

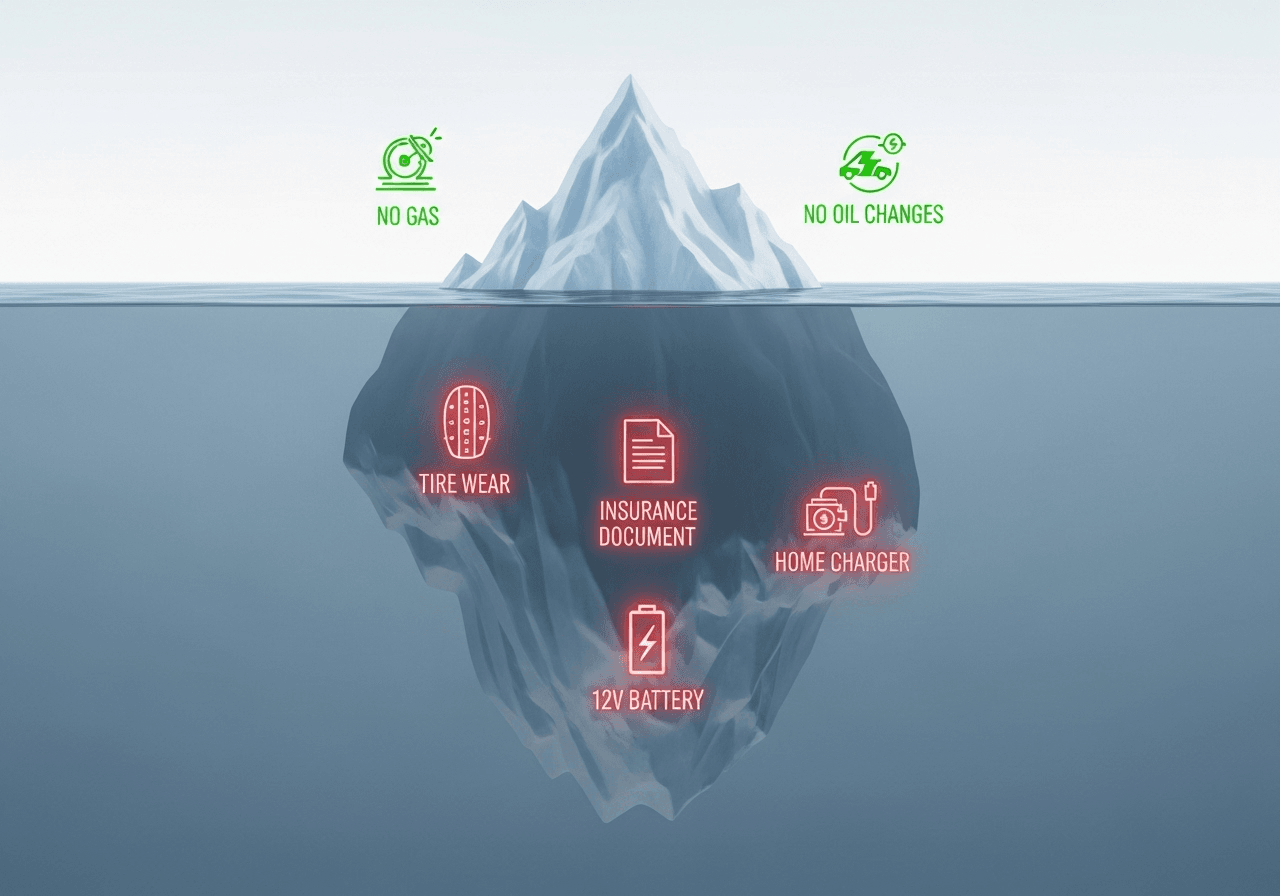

How do energy storage and EV chargers affect incentive eligibility?

Adding battery storage or EV infrastructure often qualifies for additional credits under both federal and state programs, enhancing your total benefits.

The Final Word: Your 2025 Clean Energy Playbook

At Vecharged, we see 2025 as a pivotal year for clean energy adoption. The complex, evolving incentive landscape designed around the Inflation Reduction Act and Section 45X, coupled with strategic state programs, offers unprecedented opportunities. But complexity demands clarity—and that’s where we deliver.

Our expert verdict: Don’t let confusion stall your clean energy investment. Arm yourself with knowledge, blend federal and state incentives wisely, and tap expert resources to maximize your benefits.

This is more than a savings strategy; it’s a critical investment in a cleaner, more resilient future. Power up, optimize, and lead the charge.

You can download the full document here:

Suhas Shrikant is the founder of Vecharged and an engineering enthusiast specializing in high-power off-grid solar systems. He has designed and built over a dozen custom systems and uses his hands-on, field-tested experience to create Vecharged’s expert guides and reviews.