By Rahul — EV owner, reviewer, and long-time clean energy enthusiast

Financing or leasing an electric car in early 2026 is not the same as it was just one year ago. The biggest shift was the end of all federal EV tax credits on September 30, 2025, including:

- The $7,500 Clean Vehicle Credit

- The $4,000 Previously-Owned EV Credit

- The commercial lease credit manufacturers had been using

Manufacturers can no longer claim any of these credits from the IRS.

What happened next was predictable:

Brands like Ford and GM began subsidizing leases themselves to stop monthly payments from jumping overnight.

These 2025-style incentives are still influencing the market in early 2026, but they are no longer guaranteed, and many expired on December 31, 2025.

Important: Incentives and APRs discussed here reflect the transition period between late 2025 and early 2026. Always verify current offers—manufacturers update rates monthly.

Financing an EV in 2026: What Actually Matters

As someone who’s financed multiple EVs over the past decade, I can tell you that 2026 buyers must understand three core trends.

1. Interest rates remain elevated for used EVs

Late-2025 and early-2026 APRs show a clear pattern:

New EV Loans: 5.9%–8.9%

Used EV Loans: 8.5%–12.5%

Manufacturer Promo Rates (2026): 0%–3% (varies monthly)

Examples as of early 2026 (based on Q4 2025 rollovers):

- Ford Mach-E: 0% APR up to 60 months (may change after Q1 2026)

- Rivian R1T/R1S: 3.99% APR on select models

- Chevy Equinox EV: 0% APR for 60 months in several regions

The pattern is simple:

Automakers are still using interest-rate incentives to replace the lost federal tax credit.

2. Depreciation is now a built-in risk factor for lenders

EVs continue to show higher depreciation compared to gas vehicles.

Five-year averages:

- Tesla Model Y: ~61% depreciation

- Hyundai Ioniq 5: ~60%

- Kia EV6: ~61.5%

- Nissan Leaf: ~44% (a notable exception)

Because of this, lenders in early 2026:

- Tighten loan-to-value (LTV) ratios

- Add risk premiums for long loan terms

- Treat certain brands as “high depreciation risk”

Depreciation influences both approval and pricing more than ever before.

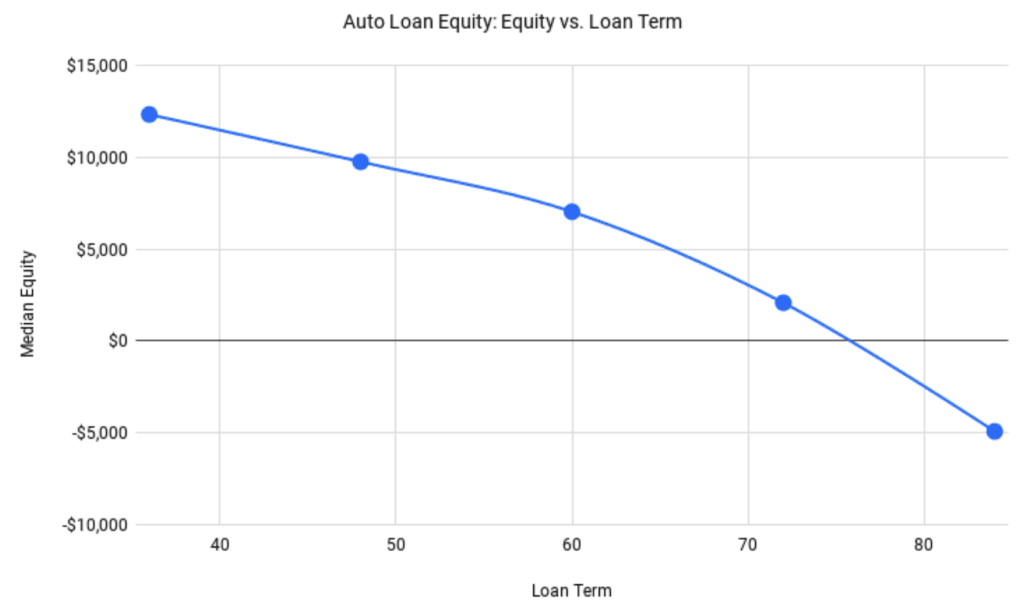

3. Long-term EV loans (72–84 months) still exist — but cost more

Unlike what some assume, these terms were not eliminated:

- 72-month EV loans are still common

- 84-month loans are available through manufacturers and credit unions

But:

- APRs increase noticeably for long terms

- GAP insurance is often mandatory

- Some lenders reduce LTV limits for 72+ month loans

Manufacturers may continue subventing long-term APRs through early 2026, but incentives from 2025 are not guaranteed to continue.

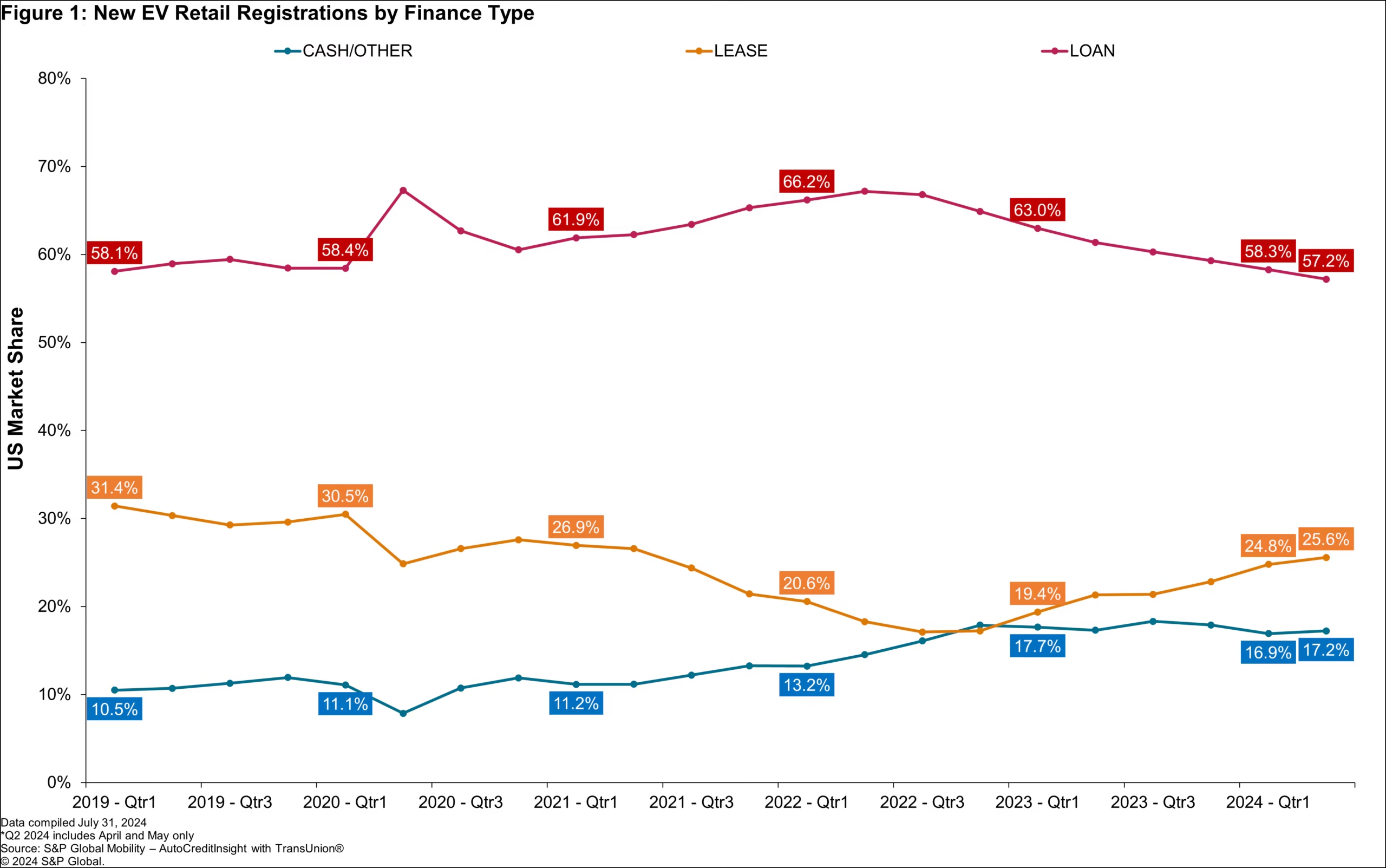

Financing vs. Leasing in 2026: How to Decide

The EV market is shifting quickly, but the decision framework is clearer than ever.

When Financing Makes Sense (2026)

You should lean toward financing if you:

- Plan to keep the EV for 6–10 years

- Drive more than 12,000 miles per year

- Prefer ownership without mileage restrictions

- Are buying a 3–4 year-old used EV that already absorbed its main depreciation hit

Used EVs from 2021–2023 are particularly attractive in 2026.

Best EVs to finance in 2026 (used):

- 2021–2023 Tesla Model 3

- 2021–2023 Tesla Model Y

- 2022–2023 Hyundai Ioniq 5

- 2022–2023 Kia EV6

These models show consistent resale demand and predictable long-term costs.

When Leasing Makes Sense (2026)

Leasing is the stronger choice if you:

- Want the newest tech every 2–3 years

- Prefer stable monthly payments

- Don’t want long-term battery degradation risk

- Are choosing a model with uncertain resale value

Best EVs to lease entering 2026:

- Ford Mustang Mach-E

- Rivian R1T / R1S

- Chevy Equinox EV

Time-Sensitive Note:

Many Ford, Rivian, and Chevy lease programs from Q4 2025 expired on December 31.

Early 2026 incentives will likely differ. Always check the latest offers.

EV Loan vs. Lease: Total Cost Analyzer

Compare the true financial commitment of buying vs. leasing your next EV.

1. Vehicle & Down Payment

2. Loan Details (Buying)

3. Lease Details (Renting)

4. Financial Comparison (Loan Term: 5 Years vs. Lease Term: 3 Years)

| Metric | LOAN (Ownership) | LEASE (Use) |

|---|---|---|

| **Monthly Payment (Est.)** | — | — |

| **Total Paid Over Term** | — | — |

| **Net Equity / Cash Value** | — | — |

**Disclaimer:** Loan Equity assumes vehicle sale at term end. Lease Equity is the cost of not owning the vehicle.

If you are comparing the value of buying new vs used, see our detailed breakdown here

How to Get the Best EV Financing Rate (My Process)

Over the years, I’ve learned that securing the best rate is less about “finding the right bank” and more about understanding how lenders assess risk.

1. Choose a brand with stable resale value

Banks reward low-risk EV brands with better APRs.

Lower-risk brands (2026):

- Tesla

- Rivian

- Hyundai

- Kia

- Ford (specific models)

Higher-risk brands:

- Early Nissan Leafs

- Older Chevy Bolts

- EVs without active cooling

Brand matters more than most buyers realize.

2. Increase your down payment

A higher down payment reduces lender risk and improves APRs.

My recommendations:

- 10% down for new EVs

- 20% down for used EVs

This keeps you from going underwater in the early years.

3. Compare offers from three different lender categories

Each has pros and cons:

| Lender Type | Best For | Notes |

|---|---|---|

| Banks | New EVs | Conservative but stable |

| Credit Unions | Used EVs | Often the best APR for 3–5-year-old EVs |

| Manufacturer Financing | New leases and loans | Best for promo rates |

Never rely on a single lender.

Rates for EVs can vary significantly across institutions.

4. Use a battery SOH report to strengthen your position

Battery State of Health (SOH) is becoming increasingly important in 2026.

While not mandatory for all lenders, it is:

- Required by many dealers for trade-ins

- Used by EV-focused lenders

- A strong negotiation tool for buyers

Accepted sources:

- OEM diagnostic tools

- Recurrent Auto reports

- Dealership service reports

If you’re buying used, I wouldn’t proceed without one.

How to Get the Best EV Lease Deal in 2026

Leasing EVs is different from leasing gas cars. Here’s what to focus on.

1. Search for models with excess dealer inventory

High inventory = better lease terms.

Models often affected:

- Mustang Mach-E

- Ioniq 5 / EV6

- Equinox EV

Inventory pressure leads to:

- Below-invoice pricing

- Added lease cash

- Dealer flexibility

2. Ask the dealer one key question

This uncovers incentives 90% of buyers never see:

“What factory lease cash applies to this VIN today?”

This has saved me thousands over the years.

3. Understand lease return tire rules

EVs require High Load (HL) tires due to vehicle weight.

If you return a leased EV with standard tires—even if new—you may face:

$900–$1,200 in tire replacement charges.

Lease inspectors now check tire load rating, not just tread depth.

4. Choose the right mileage plan

- Under 12,000 miles/year → lease is fine

- Over 15,000 miles/year → financing is usually cheaper

This is where most lessees lose money.

Important Disclaimers for 2026 Buyers

1. Used EV Tax Credit Holdover Clause

If you purchased a qualifying used EV on or before Sept 30, 2025, and place it in service afterward, you may still be eligible for up to $4,000.

This applies only to buyers who signed before the deadline.

2. Incentives Change Monthly

Lease and APR deals mentioned here reflect the transition between late 2025 and early 2026.

Always verify current incentives directly with manufacturers or dealers.

3. Geographic Note

This guide applies to U.S. EV financing and leasing. Other countries follow different rules, rates, and incentives.

Conclusion: The Smartest Move in 2026

If you want the lowest total ownership cost:

Finance a 3–4-year-old EV with strong battery health.

If you want predictable payments and worry-free ownership:

Lease a new EV with manufacturer-backed incentives.

If you want long-term value and plan to keep the vehicle:

Finance new from a brand with strong resale performance.

The right answer depends on your financial priorities—but in 2026, the fundamentals have never been clearer.

I’ve been driving, testing, and living with electric vehicles for years — from early compact EVs to today’s high-performance models. My journey into e-mobility started out of curiosity but quickly turned into a mission to help others make smarter EV choices. At VeCharged, I break down real-world ownership insights, cost analysis, and charging know-how so you can buy, sell, or switch to an EV with total confidence.