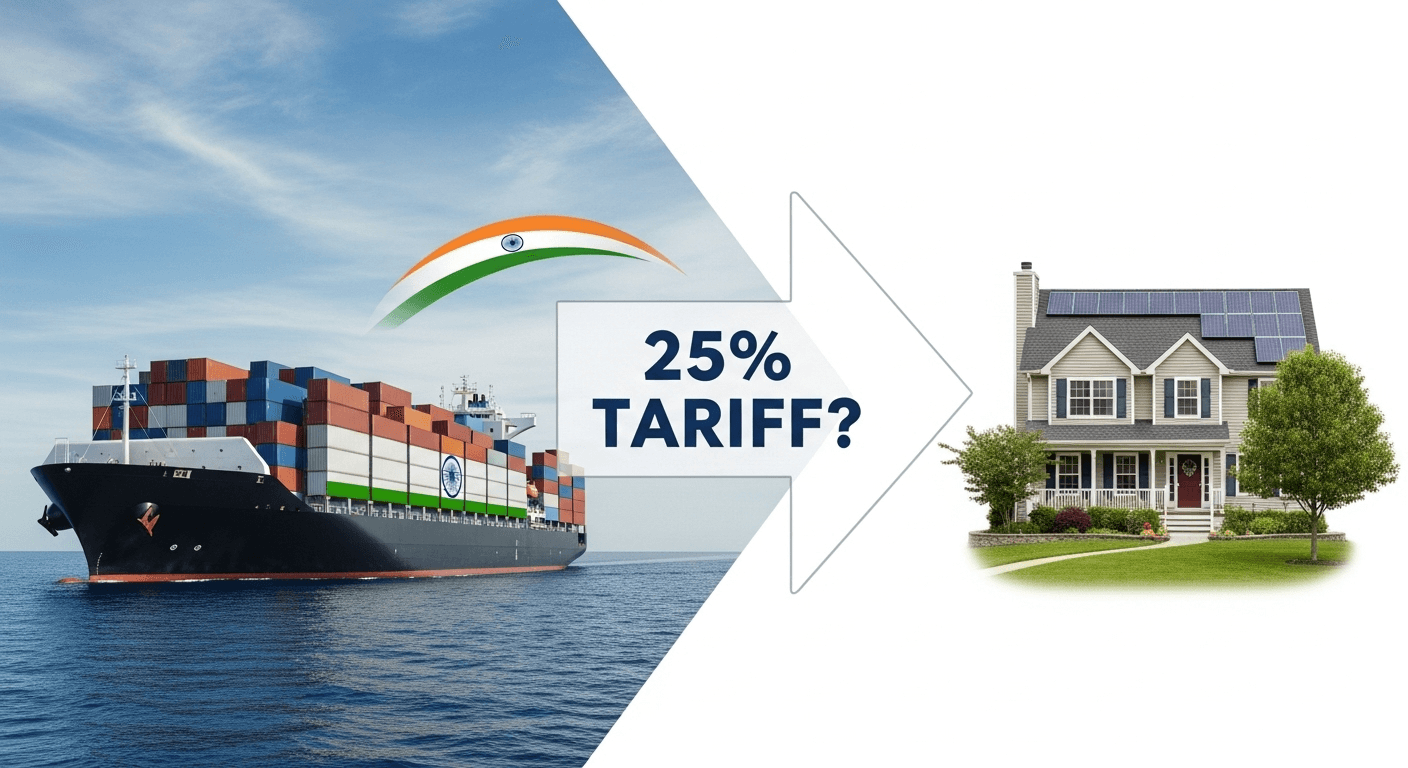

A potential 25% tariff on Indian solar imports is making headlines. We break down the complex trade puzzle and explain the real-world impact it could have on the cost of your home solar project.

In the world of solar energy, headlines about tariffs, trade disputes, and international politics can feel a world away from the decision to put panels on your own roof. But a recent proposal could have a direct impact on your wallet.

Former President Trump has proposed a broad 25% tariff on all imports from India. While not specifically targeting solar, this would include the solar panels and components that are a growing and important part of the U.S. supply chain. The industry is buzzing, but the noise can be confusing.

So, what does this actually mean for the price of a home solar installation in the United States? We’re here to cut through the noise and give you the clear, expert analysis you need.

The Big Picture, Made Simple: Why This Matters

To understand the impact, you first need to understand the global solar landscape. For years, the U.S. has been working to build its domestic solar manufacturing capacity, but the reality is that the industry still relies on a complex web of global suppliers to meet demand and keep costs low.

India has recently emerged as a key player in this supply chain, offering high-quality solar components and providing a valuable alternative to other manufacturing hubs in Southeast Asia. A sudden 25% tariff on these goods doesn’t just affect one country; it sends a ripple through the entire “trade puzzle,” impacting the cost and availability of materials for installers across America.

The Direct Impact: A Tale of Two Timelines

This proposal will affect the market differently in the short term versus the long term.

The Short-Term Impact (The Next 6-12 Months)

If a new tariff were enacted, the most immediate effect would be uncertainty.

- Potential for Price Spikes: A sudden 25% tax on panels from a major supplier would almost certainly lead to a short-term increase in the cost of those specific components.

- Installer Scramble: Your local solar installer, who may have been planning to projects using Indian-made panels, would have to quickly find a new supplier. This could cause project delays or force them to use more expensive alternatives, potentially raising the price of their quotes.

- The Bottom Line: This proposal creates a cloud of uncertainty. In the short term, it could lead to higher quotes from some installers as they try to price in the financial risk of a changing and unpredictable market.

The Long-Term Impact (1-3 Years from Now)

The U.S. solar market is incredibly resilient and adaptable. After any initial shock, the long-term effects would likely be a strategic reshuffling.

- A Boost for US Manufacturing: The primary stated goal of tariffs is to make domestically produced goods more competitive. A move like this could accelerate the “Made in America” solar manufacturing boom that was kickstarted by the Inflation Reduction Act (IRA), leading to more domestic jobs and a more secure local supply chain.

- A Shift in Supply Chains: Installers and distributors would adapt. They would likely increase orders from other tariff-free regions like South Korea or Southeast Asia, or double down on U.S.-made panels from brands like Qcells.

- Price Stabilization: After a period of volatility, the market would likely stabilize. The most powerful force in the solar industry is the relentless march of technological innovation, which consistently drives down the cost of production. A single tariff is unlikely to stop this powerful long-term trend.

The Vecharged Verdict: What Should You Do?

This is the most important part. How should this news affect your decision-making process right now?

- If You’re About to Sign a Contract: Have a direct conversation with your installer. Ask them, “Are the panels for my project sourced from India, and does my quote account for any potential tariff volatility?” A good, transparent installer will appreciate the question and have a clear answer.

- If You’re Just Starting to Look: Don’t panic or delay your plans. This news might cause some short-term price fluctuations, but it does not change the fundamental value proposition of going solar. Your strategy should remain the same: get multiple quotes from reputable local installers. This will give you the clearest picture of the current market price in your specific area.

- The Bigger Picture: Ultimately, this is a high-level political issue. The most powerful trend in energy is not politics; it’s the relentless innovation that continues to make solar power the most affordable form of energy in human history. That is a trend you can bet on.

Conclusion: From Puzzle to Perspective

The U.S.-India solar trade puzzle is complex, but the takeaway for you, the homeowner, is simple. While political winds can cause short-term turbulence, they don’t change the direction of the ship. The transition to clean, affordable, and domestically-controlled energy is inevitable. Your decision to go solar remains one of the smartest long-term investments you can make for your home and your wallet.

Suhas Shrikant is the founder of Vecharged and an engineering enthusiast specializing in high-power off-grid solar systems. He has designed and built over a dozen custom systems and uses his hands-on, field-tested experience to create Vecharged’s expert guides and reviews.