For over a century, the value of an automobile was forged in steel and measured in horsepower. That era is over. The automotive semiconductor market, valued at over $70 billion in 2025, is projected to surge to more than $120 billion by the early 2030s, and the battle for its most valuable segment—centralized compute—is a war fought in trillions of operations per second (TOPS).

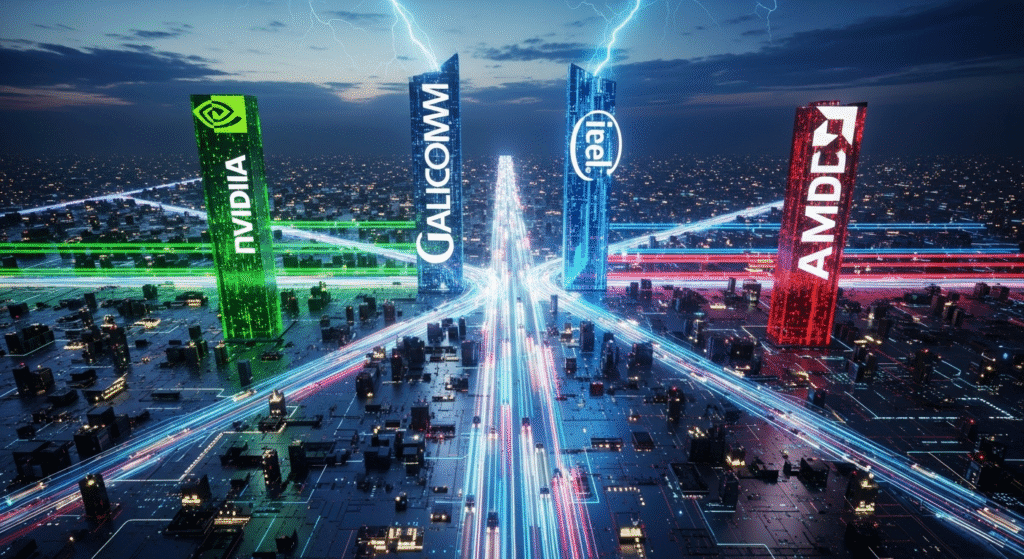

The modern car is a computer on wheels, and its value is now measured by the power of its silicon heart. This fundamental shift has ignited a brutal conflict for control of the vehicle’s “digital chassis.” The legacy automotive supply chain is being upended, and the winners of this new silicon war—pitting giants like NVIDIA, Qualcomm, Intel (Mobileye), and AMD against each other—will not just supply a part; they will define the very architecture and identity of the automobile for the next generation.

The Great Consolidation: From 100 ECUs to a Single Brain

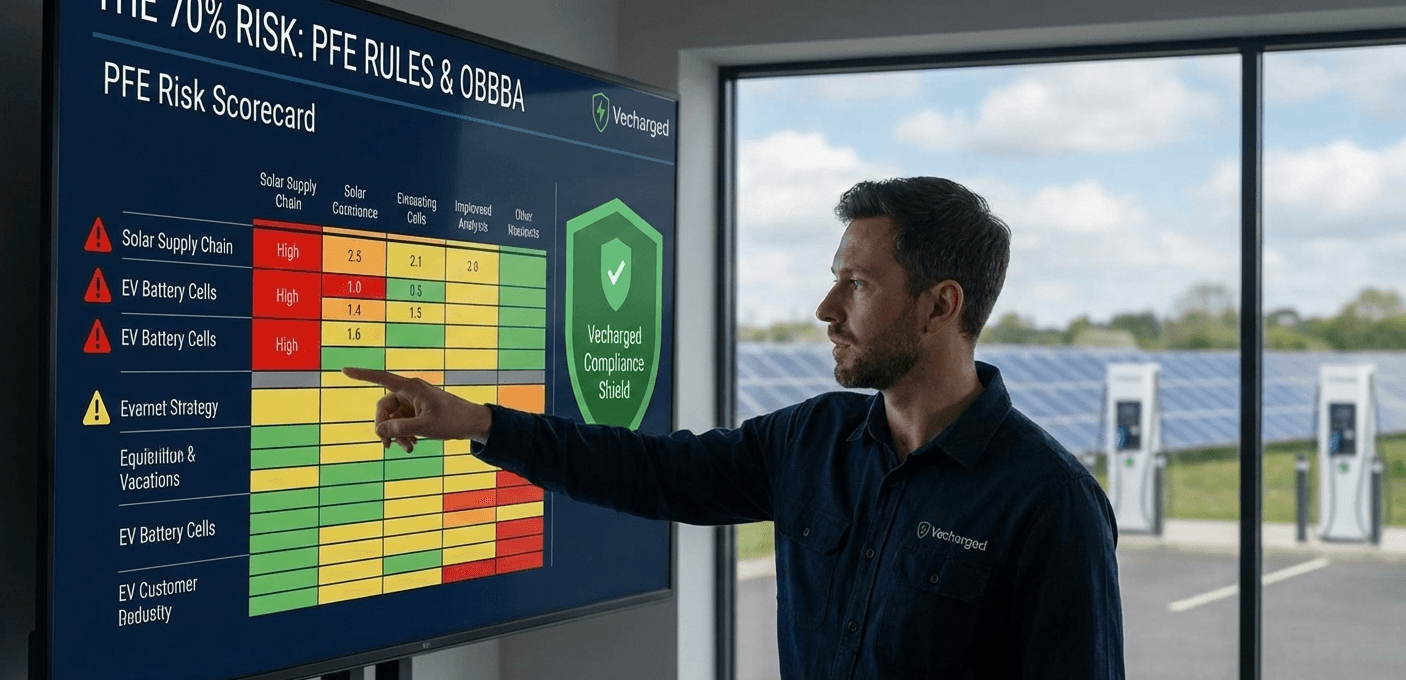

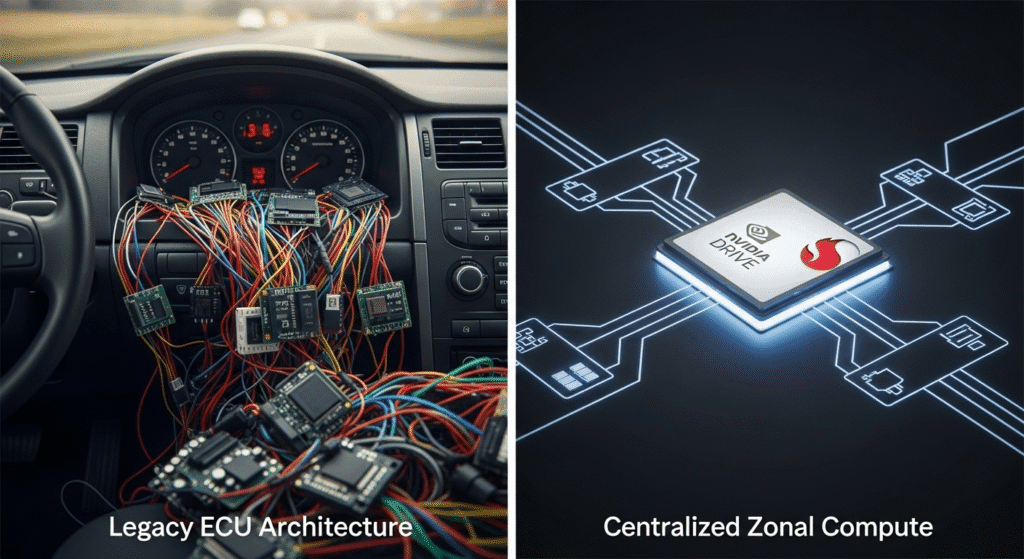

To grasp the scale of this battle, one must first appreciate the architectural revolution. A traditional car contains a sprawling, decentralized network of 80 to 150 individual Electronic Control Units (ECUs). This creates a complex, heavy, and inflexible “spaghetti” of wiring that is impossible to update meaningfully over the air.

The software-defined vehicle (SDV) demolishes this model. Inspired by Tesla, automakers are stampeding towards a centralized or zonal compute architecture. Here, the dozens of small ECUs are consolidated into a handful of powerful domain controllers, all managed by one or two central “supercomputers” or Systems on a Chip (SoCs) that run a software stack now exceeding 150 million lines of code.

Deep Dive: Strategies and Market Position

1. NVIDIA: The Full-Stack AI Brain

NVIDIA’s strategy is a top-down assault, leveraging its dominance in AI data centers to own the vehicle’s autonomous brain. Their automotive design-win pipeline now stands at over $14 billion.

- Technology: The current-generation DRIVE Orin SoC (254 TOPS) is already a powerhouse in production vehicles. But the true weapon is the next-generation DRIVE Thor, a single “superchip” delivering an astonishing 2,000 TOPS designed to centralize everything from autonomous driving to infotainment. The first Thor-powered vehicles are slated for production in 2025.

- Strategy: NVIDIA is selling a turnkey, vertically integrated system, attractive to automakers who want a best-in-class AV solution without the massive R&D of developing their own software stack.

2. Qualcomm: The Modular Digital Chassis

Leveraging its mobile dominance, Qualcomm has become an automotive titan, boasting the industry’s largest design-win pipeline, valued at over $40 billion.

- Technology: The Snapdragon Digital Chassis is a suite of platforms. While the Snapdragon Cockpit platform is the market leader for infotainment, their Snapdragon Ride platform for ADAS is highly scalable, offering solutions from 30 TOPS up to 2,000+ TOPS.

- Strategy: Qualcomm’s modular “best-of-breed” approach resonates with legacy automakers like GM and BMW, who are wary of ceding total control of the vehicle’s brain to a single supplier.

3. Intel (via Mobileye): The Incumbent ADAS Specialist

Intel’s primary weapon is its subsidiary, Mobileye, which still dominates the ADAS landscape with an estimated market share that analysts place as high as 80% for vision-based safety systems.

- Technology: Mobileye’s EyeQ family of SoCs are highly efficient, lean processors. Their future is pinned on the EyeQ Ultra, a purpose-built AV-on-a-chip delivering 176 TOPS at high efficiency.

- Strategy: Mobileye offers a full-stack, vision-first “black box”—their chip, cameras, crowdsourced maps (REM), and proprietary driving policy software, making them the trusted, default partner for regulated safety features for years.

4. AMD: The Powerful Enabler

While not offering a full platform, AMD has secured a critical beachhead in the automotive market.

- Technology: AMD’s major coup was securing the infotainment processor spot in Tesla’s entire vehicle lineup with its powerful Ryzen APUs, providing the gaming-level performance that defines Tesla’s user experience.

- Strategy: AMD is executing a focused strategy to be the premier supplier for the increasingly complex digital cockpit, leveraging its PC and console gaming expertise.

The Road Ahead: A New Automotive Value Chain

The strategic implications are profound. The battle is forcing automakers to redefine themselves as software integrators. The choice of a silicon partner, a decision that now happens 5-7 years before a car hits the road, is arguably more critical than the choice of a battery supplier.

Geopolitical factors, particularly the industry’s reliance on TSMC for advanced chip fabrication, add another layer of systemic risk. The automakers that will win the next decade will be those that master this new, complex value chain. The heart of the car is now a chip, and the design wins announced today are the clearest indicator of the automotive leaders of 2030.

I’m a writer and analyst who explores the clean energy transition, with a focus on electric vehicles and solar power.

My journey began five years ago as a firm skeptic. Determined to debunk the hype around EVs, my in-depth research led to an unexpected conclusion: the future I was questioning was already here. This realization didn’t just change my mind; it put me in the driver’s seat of my own EV.

Today, I’m passionate about sharing the clarity I found. I provide the practical, data-driven insights people need to feel confident and excited about navigating their own path to a sustainable future.