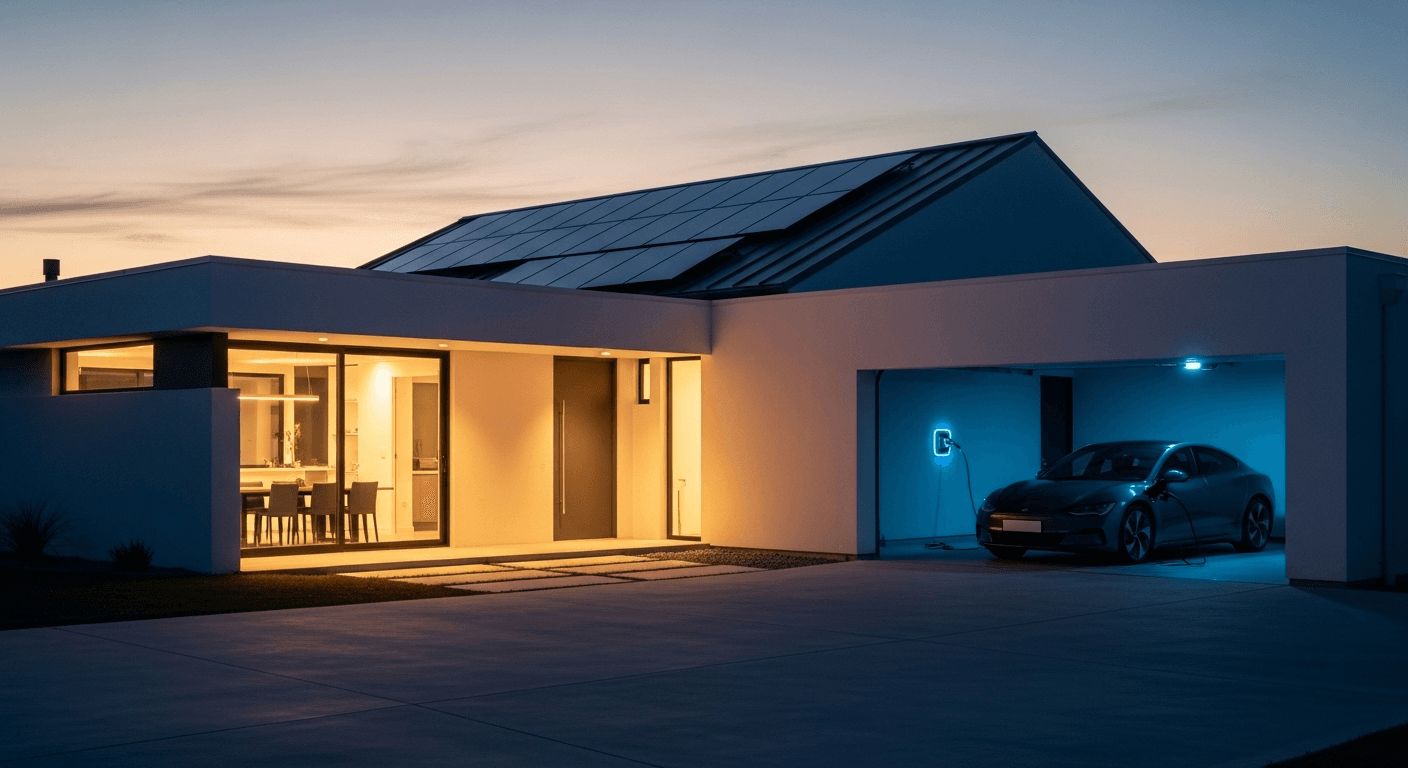

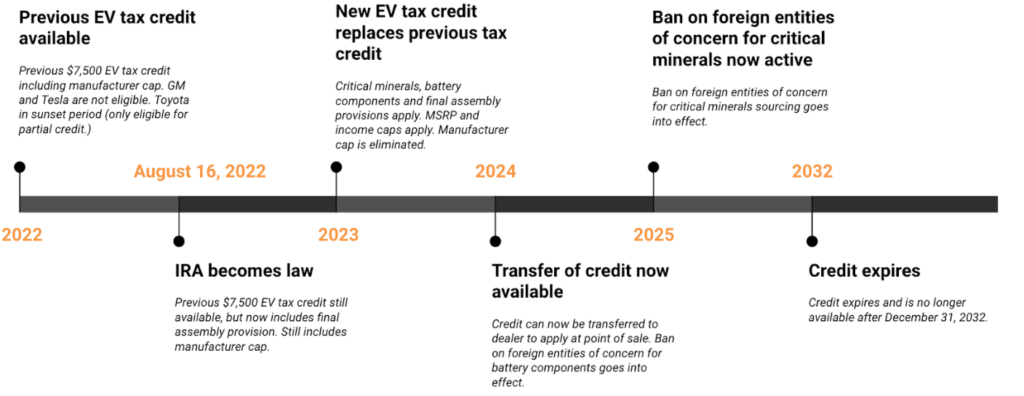

The American clean energy landscape shifted on its axis on July 4, 2025. With the signing of the One Big Beautiful Bill Act (OBBBA), the rules for Solar and EV incentives were entirely rewritten.

If you are a developer, fleet manager, or investor, you are no longer just in the business of energy; you are in the business of forensic supply chain auditing. The OBBBA has transformed tax credits from a “given” into a “target.” At the center of this bullseye is the Prohibited Foreign Entity (PFE) regime.

At Vecharged, our policy is “Protection First.” Failure to navigate these rules doesn’t just result in a smaller credit—it triggers a 100% disqualification and a 10-year recapture bomb. Here is your definitive, static guide to protecting your assets in 2026.

I. The MACR: The Only Math That Matters

Starting for projects beginning construction after December 31, 2025, your eligibility for the Section 48E Investment Tax Credit (ITC) is determined by the Material Assistance Cost Ratio (MACR).

If your project falls even 0.1% below the threshold, you lose the entire 30% base ITC. There is no partial credit.

The Escalating Compliance Roadmap (Static)

| Project Type | 2026 Threshold (Non-PFE) | 2029 Threshold (Non-PFE) | Vecharged Risk Rating |

| EV Battery Storage (BESS) | 55% | 70% | 🔴 Critical |

| Solar Power Facilities | 40% | 55% | 🟡 Elevated |

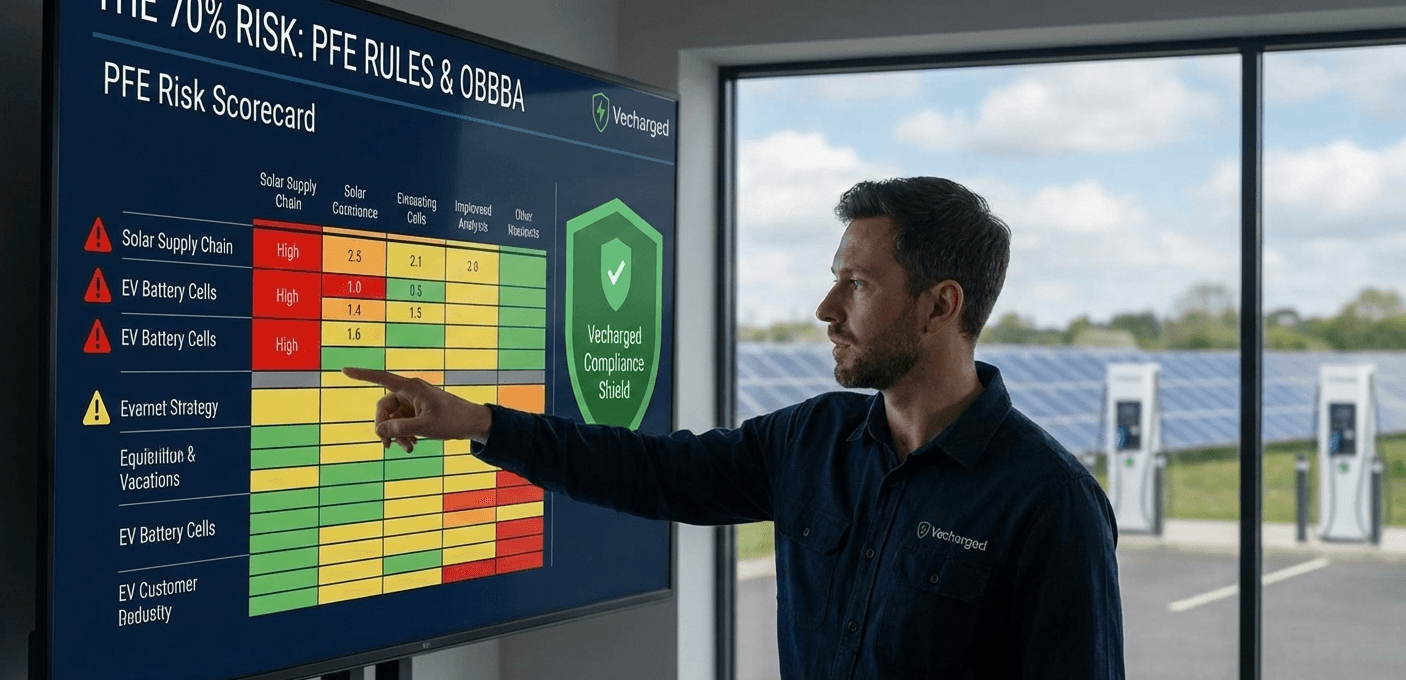

II. The Vecharged PFE Risk Scorecard

Use this proprietary matrix to evaluate your 2026 procurement plan. This is a static assessment of where your Solar and EV ROI is most vulnerable to IRS clawbacks.

| Component Category | PFE Risk Level (1-5) | The “Hidden” PFE Trigger | Vecharged Protective Strategy |

| LiFePO4 Cells | 5 (Highest) | PFE-linked Anode/Cathode precursors. | Trace materials to the source mine. |

| Solar Inverters | 4 (High) | PFE-owned cloud monitoring/firmware. | Demand U.S.-hosted software & IP. |

| EV Charging Units | 3 (Moderate) | PFE control of power electronics. | Audit the PCB (Circuit Board) assembly. |

| BMS Software | 4 (High) | Remote shutdown “Effective Control.” | Verify PFE-free source code ownership. |

| Solar Racking | 1 (Lowest) | Raw steel/aluminum sourcing. | Easiest to swap; focus on Domestic Content. |

III. The 10-Year Recapture “Time Bomb”

Standard tax credits vest in five years. The OBBBA doubles that window to ten years for PFE violations. This is known as the “Applicable Payment” rule.

The Trap: If, in the year 2032, you pay a PFE-linked entity for a software patch or a replacement part that grants them “effective control” over your system, the IRS can claw back 100% of the credit you claimed in 2026.

IV. The Vecharged Verdict: How to Build a Shield

To get your project financed in 2026, a simple “Made in USA” sticker is insufficient. You need a Vecharged Compliance Shield:

- Front-Load Your Spares: Buy 5-10 years of critical spare parts (inverters, BMS boards) in your initial 2026 contract to avoid future payments to potentially non-compliant entities.

- Tier 3 Traceability: Don’t just audit your supplier; audit your supplier’s supplier. If the cathode powder comes from a PFE, your 55% MACR score is in jeopardy.

- Indemnification: Your contracts must include a PFE Recapture Indemnity Clause that survives for 11 years (10 years of risk + 1 year for audit lag).

The Bottom Line: In the OBBBA era, a “cheap” PFE-linked component is the most expensive mistake you can make. Compliance is the new ROI.

I’m a writer and analyst who explores the clean energy transition, with a focus on electric vehicles and solar power.

My journey began five years ago as a firm skeptic. Determined to debunk the hype around EVs, my in-depth research led to an unexpected conclusion: the future I was questioning was already here. This realization didn’t just change my mind; it put me in the driver’s seat of my own EV.

Today, I’m passionate about sharing the clarity I found. I provide the practical, data-driven insights people need to feel confident and excited about navigating their own path to a sustainable future.