The new broad-duty tariff is a direct geopolitical action designed to make the EV supply chain dramatically more expensive.

EV Tariff Cost Risk Calculator

Estimate the potential cost increase on your battery pack from new import duties.

1. Select Your Vehicle’s Battery Size

2. Select Your Battery Chemistry (Cost Basis)

3. Estimated Tariff Cost Shock

**VERDICT:** This duty represents the **direct financial risk** to the automaker, which may be transferred to you as a higher vehicle price or lost incentives.

The market instability created by the October 10th tariff announcement is forcing automakers to redefine their supply chains overnight. I will audit the true risk by separating the policy reality from the market panic and show you which brands and battery chemistries offer the best defense against this geopolitical storm.

1. THE GEOPOLITICAL BOMBSHELL: Two Distinct Tariff Actions

The current market shock is the result of two separate, compounding U.S. tariff actions aimed at decoupling the energy supply chain from China.

What is the impact of the 100% tariff on EV prices?

The tariffs create a surge in cost for automakers who have not localized their supply chains, affecting raw material costs, which are then passed to the consumer.

| Tariff Action | Effective Date | Exact Product Scope |

| Biden’s EV Duty | September 2024 | 100% tariff solely on fully built Chinese electric passenger vehicles. |

| Trump’s Broad Duty | Announced October 10, 2025 (Effective Nov 1) | Up to 100% additional duties on battery cells, critical minerals, and components. |

The true weapon is the Trump Broad Duty targeting battery materials used in final assembly, which dramatically increases the cost of battery packs for automakers still reliant on China for components.

2. THE MARKET SHOCK: Crypto Volatility and Geopolitics

The massive market volatility trending today was a direct, immediate response to the October 10th broad tariff announcement, underscoring the grid’s systemic risk.

Why is the stock market/crypto down?

The $19 billion crypto liquidation spike and the sell-off in equity indices (S&P 500, Nasdaq) were triggered exclusively by President Trump’s October 10 announcement.

- Grid Instability: The crypto market’s massive, energy-intensive mining load contributes to grid instability, making it vulnerable to any economic shock that triggers mass power usage shifts.

- The Investment Warning: The crash is a clear signal that geopolitical risk is now a primary driver of market value, demanding defensive investment in stable assets.

3. THE CONSUMER’S DEFENSE: Which Brands and Batteries Are Safe?

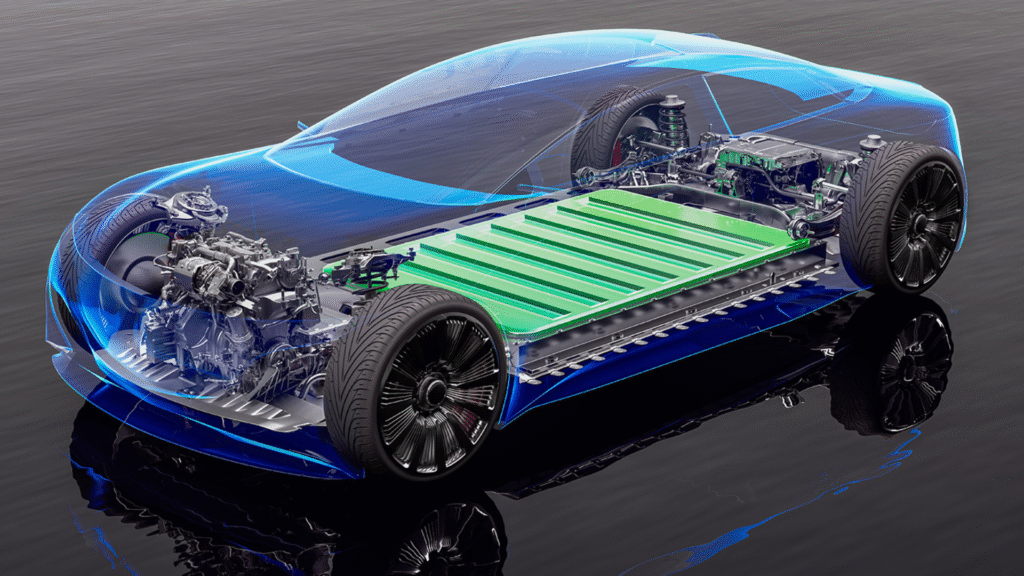

The tariffs force automakers to choose between cost savings (LFP) and range (NCM), with localization being the ultimate shield.

Tariff Impact on Batteries & U.S. Battery Market

The choice of battery chemistry is your first line of defense:

- LFP (Lithium Iron Phosphate): These packs are roughly 20% cheaper per kWh than NCM packs and rely on more abundant iron and phosphate.

- The Trade-off: LFP has lower energy density, limiting EV range to approximately 200–250 miles (vs. 300+ miles for NCM).

- The Caveat: China produces over 95% of global LFP cells. Even U.S.-assembled LFP packs remain exposed until upstream materials (lithium hydroxide, cathode precursors) are localized.

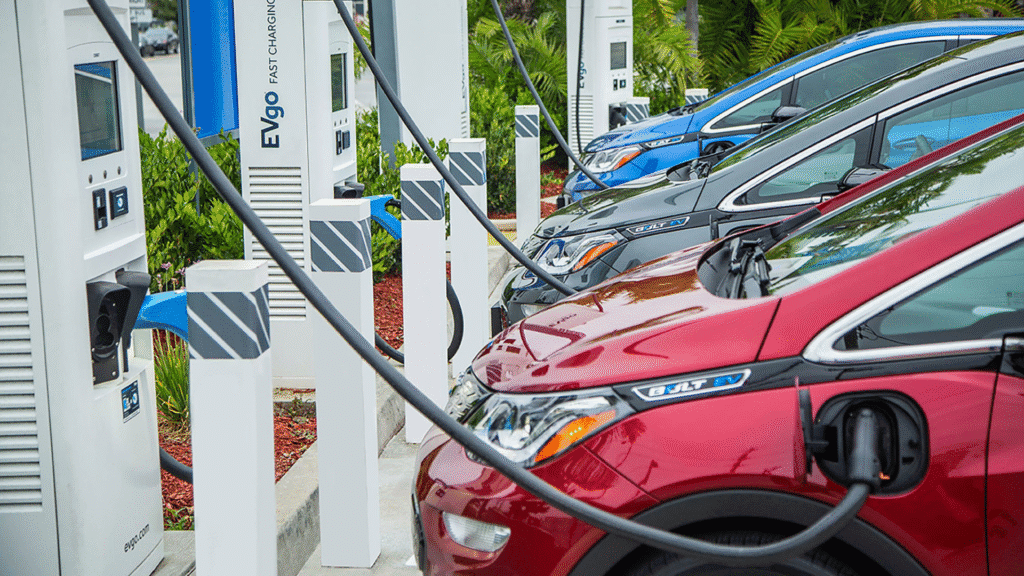

- Brand Localization: The Safest Strategy: Domestic cell assembly by brands like Ford and Tesla mitigates risk, but does not fully eliminate it. These plants remain dependent on imported upstream materials that are subject to global commodity markets and new tariffs.

4. THE INVESTOR’S HEDGE: Lithium, BESS, and Energy Storage

The tariffs act as a catalyst, accelerating a necessary, long-term investment trend toward domestic energy resilience.

Battery Storage Tariffs & BESS Tariff

- Primary Driver: BESS market expansion is fundamentally driven by decarbonization mandates, grid-stabilization needs, and renewable integration forecasts.

- The Accelerating Factor: The tariffs serve as an accelerating catalyst, boosting the strategic urgency to deploy localized BESS aggressively, as it provides security independent of volatile global commodity markets and geopolitical shocks.

- The Investment Play: This policy accelerates opportunities for North American lithium mining, refining, and battery manufacturing stocks that can supply the domestic EV and grid markets.

The market is being driven by fear, but the underlying engineering truth is stability. The Trump tariffs act as a permanent market shock, forcing the entire industry to localize. For the consumer, this means short-term price volatility, but for the investor, it means high-value opportunities in domestic battery and energy storage companies. The new geopolitical risk is your ultimate guide to selecting the most resilient EV brands.

I’ve been driving, testing, and living with electric vehicles for years — from early compact EVs to today’s high-performance models. My journey into e-mobility started out of curiosity but quickly turned into a mission to help others make smarter EV choices. At VeCharged, I break down real-world ownership insights, cost analysis, and charging know-how so you can buy, sell, or switch to an EV with total confidence.