My expert guidance for navigating the post-credit market dip and locking in your final federal incentives.

Let’s be clear: The $7,500 New EV Tax Credit did not expire because of the government shutdown.

The major $7,500 EV Tax Credits and the $4,000 Used EV Credits were officially repealed on September 30, 2025, by the One Big Beautiful Bill Act (OBBBA). The government shutdown began on October 1st.

However, the shutdown is not just political theater; it’s an unavoidable exacerbation of an already unstable situation. The IRS was already struggling to issue compliance guidance in September, and a shutdown is guaranteed to bottleneck the process further, exposing clean energy consumers to unprecedented risk.

Post-Credit EV Negotiation Advantage Tool

Determine your optimal opening offer now that the $7,500 federal credit is gone.

Your Strategic Target Deal

As an engineer and clean energy strategist, my advice is now hyper-focused. The short-term pain is the credit’s death; the long-term threat is the push for wider rollbacks (like those in Project 2025). Your strategy must be to act smart to capitalize on the market shift and secure the remaining, highest-value incentives before they vanish entirely.

Here are the 5 critical financial moves you must make now.

1. Mitigate Risk: Lock Down Your Expired EV Credit Paperwork

If you purchased or signed a binding contract for an EV on or before September 30, 2025, your claim for the credit is in limbo. The IRS portal for dealers to register new users is closed, and the backlog of existing claims is immense.

- The Reality: The IRS is relying on skeleton crews. The administrative delay you feared is now a certainty.

- Your Move NOW: Do not wait for tax season. Contact your dealer and demand a hard copy of the IRS Form 15400 (Clean Vehicle Seller Report), your binding written contract, and proof of payment. This documentation is your only shield against future bureaucratic confusion. The power of your tax claim rests on your paperwork, not the current government’s schedule.

2. Homeowner Priority: Capture Your Last-Chance 30% Solar Credit 💰

This is the single biggest, most immediate financial opportunity remaining. The 30% Residential Clean Energy Credit ($25D) on solar, stationary battery storage, and geothermal was accelerated by the OBBBA.

- The Hard Deadline: This uncapped 30% credit expires completely on December 31, 2025.

- The Logistical Crisis: Solar installation and commissioning often take 60 to 90 days due to local permitting and utility interconnection approvals. If you wait until November, you run a high risk of not being “placed in service” before the calendar year ends.

- Your Move NOW: Schedule a site survey and sign your installation contract this week. Focus on including battery storage, which remains eligible and is a critical hedge against both blackouts and future policy volatility.

3. Market Strategy: Prepare to Buy in the Unsubsidized Dip 📉

Industry data from Cox Automotive and J.D. Power confirms a massive sales surge in Q3 as buyers raced to beat the credit deadline. Analysts now predict a significant short-term dip in demand for Q4. This creates a buying opportunity.

- The Analyst Verdict: Over 160,000 EVs are projected to remain on dealer lots without the $7,500 incentive acting as a floor on price. Manufacturers will be compelled to absorb some of that lost value.

- Your Move NOW: Become a prepared, strategic buyer. Research the models with the highest inventory. Instead of expecting a “tax credit,” expect a significant, unadvertised discount or favorable lease term from the manufacturer and the dealer to clear inventory. Your patience is your new leverage.

4. Hedge Against Policy: Secure Remaining Non-Tax Credits 🛡️

The push from certain policy groups like Project 2025 is to eliminate all federal clean energy support. This makes local, resilient programs your most secure investment.

- The Problem: Future policy targets federal funding for grid upgrades, making local resilience a priority.

- Your Move NOW: Shift your focus from federal credits (tax-based) to state and local rebates (cash-back) for essential infrastructure. Research and claim:

- State-level EV purchase rebates (if available).

- Local utility rebates for smart Level 2 Home Charger installation.

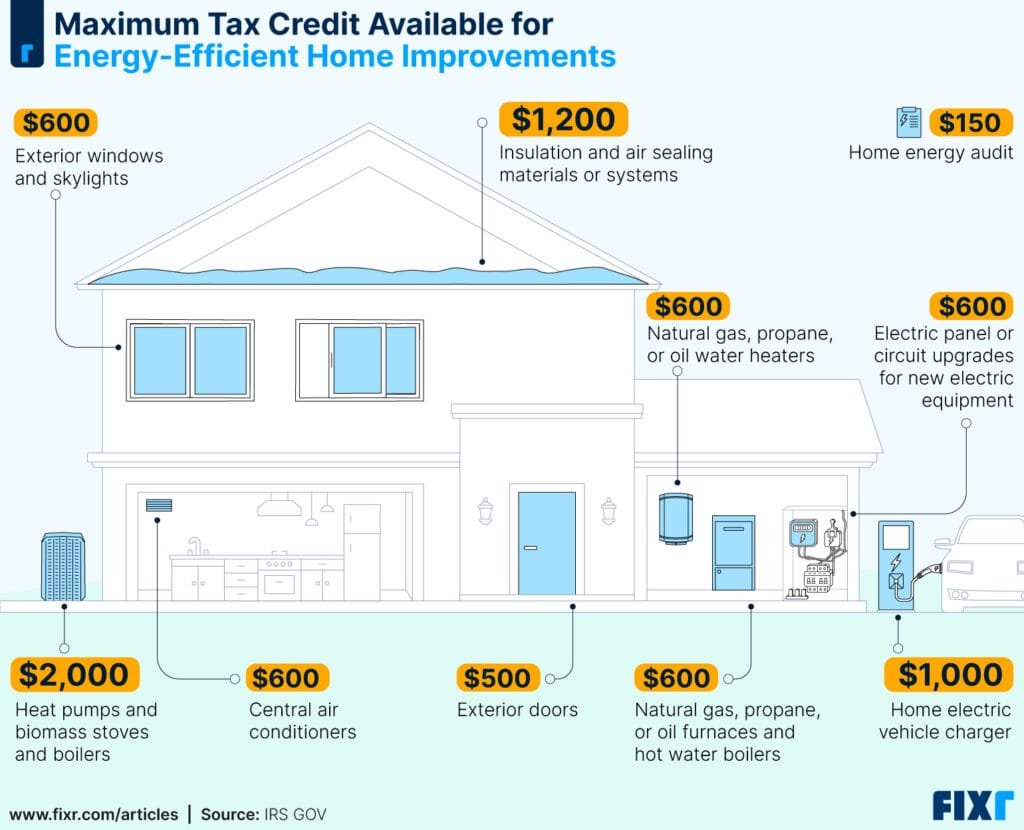

- Rebates for high-efficiency appliance upgrades (Heat Pumps, etc., which fall under the $25C credit that also expires Dec 31st).

5. Strategic Investment: Maximize Home Energy Efficiency 🏠

While the $25 solar credit is the star, don′t over look the smaller easier−to−claim Energy Efficient Home Improvement Credit.

- The Value: This credit covers 30% of certain improvements, with a total annual cap of $3,200 (e.g., $2,000 for a heat pump, and $1,200 for insulation/windows). It also expires on December 31, 2025.

- Your Move NOW: Unlike a new EV, a heat pump or insulation upgrade is an immediate, verifiable way to reduce your energy bill and establish independence from centralized energy supply. Do not let this combined $3,200 in easy savings expire.

The $7,500 credit is gone. The government is shut down. But the path to energy independence is now clearly defined by two short-term, high-value deadlines.

The political chaos simply clarifies the urgency of your last two, non-negotiable financial moves for 2025:

- Secure the 30% Solar/Storage Credit by December 31st.

- Capture the $3,200 in $25C Home Improvement Credits by December 31st.

Be the strategic expert who ignores the noise and profits from the market and legislative clarity. Actionable data always beats political anxiety.

I’ve been driving, testing, and living with electric vehicles for years — from early compact EVs to today’s high-performance models. My journey into e-mobility started out of curiosity but quickly turned into a mission to help others make smarter EV choices. At VeCharged, I break down real-world ownership insights, cost analysis, and charging know-how so you can buy, sell, or switch to an EV with total confidence.