An Engineer’s Guide to the Post-Credit Negotiation Where Manufacturer Rebates and Data Fill the Gap

While major financial publications, including the Wall Street Journal, focus on the macroeconomic fallout and sales slowdowns caused by the incentive lapse, Vecharged provides the actionable strategy. This is not a report on the industry problem; it is your definitive guide to solving the consumer problem.

The average monthly payment you’ll see for a new car hovers around $749. Don’t buy it. That number is a strategic distortion—and for the Electric Vehicle (EV) market, it hides a substantial, mandatory discount that you can exploit.

The $7,500 federal EV tax credit is gone, definitively repealed by the One Big Beautiful Bill Act (OBBBA) as of September 30, 2025. This loss creates a financial void that automakers are now compelled to fill with deep, manufacturer-backed discounts.

As an engineer and a strategist, I see this market moment as a verifiable formula for leverage. Here is the objective breakdown of why that $749 payment is misleading and how you can secure a discount that is mathematically warranted.

1. The $7,500 Gap: The Confirmed Negotiation Floor

The entire industry relied on the government to subsidize the vehicle’s purchase price by $7,500 (or $4,000 for used EVs). Automakers must now restore that value proposition to the consumer.

- The Expiration Fact: The $7,500 new EV credit and $4,000 used EV credit both ended on September 30, 2025 (Source: OBBBA).

- The Buyer Protection: You may still qualify if you entered a binding written contract and made a payment before September 30, 2025, even if delivery occurs later (Source: IRS Guidance).

- The Manufacturer Mandate: Automakers like GM, Ford, and Hyundai are offering their own temporary $7,500 rebates to directly replace the federal credit. This action confirms the financial necessity of the rebate and establishes your $7,500 baseline negotiation floor.

2. The Inventory Cost: Your $15,000 Aspirational Maximum

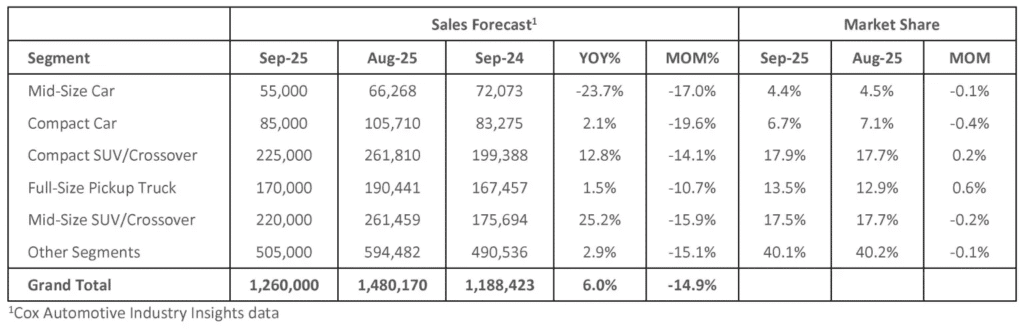

The market is currently defined by competitive pressure and manufacturer willingness to move costly inventory.

- The Inventory Reality: While EV sales hit record volume in Q3 2025, inventory still sits at approximately 91 days’ supply (Source: Industry Data). This inventory level is elevated relative to gasoline cars and confirms dealers hold surplus stock they must monetize. This inventory cost is your pressure point.

- The Strategic $15,000 Claim (Model-Specific Maximum): The potential to secure a discount up to $15,000 or more represents a best-case, model-dependent outcome. This leverage is theoretically reached by combining:

- The Manufacturer’s $7,500 Compensatory Rebate (verified).

- Additional Incentives (which, on select, high-margin, slow-selling models, can reach $8,000+).

- Vecharged Reality Check (Crucial Nuance): The $15,000 figure is an aspirational maximum applicable only to high-margin models. Most buyers should expect combined total incentives in the $7,500–$10,000 range, which is still a substantial saving.

3. The Finance Trap: How $749 Distorts the Deal Price

The focus on the monthly payment is the most significant strategic distraction from the final price you pay.

- The Accurate Cost: The average new vehicle payment is $749 on an average loan amount of $42,647 (Source: Industry Data).

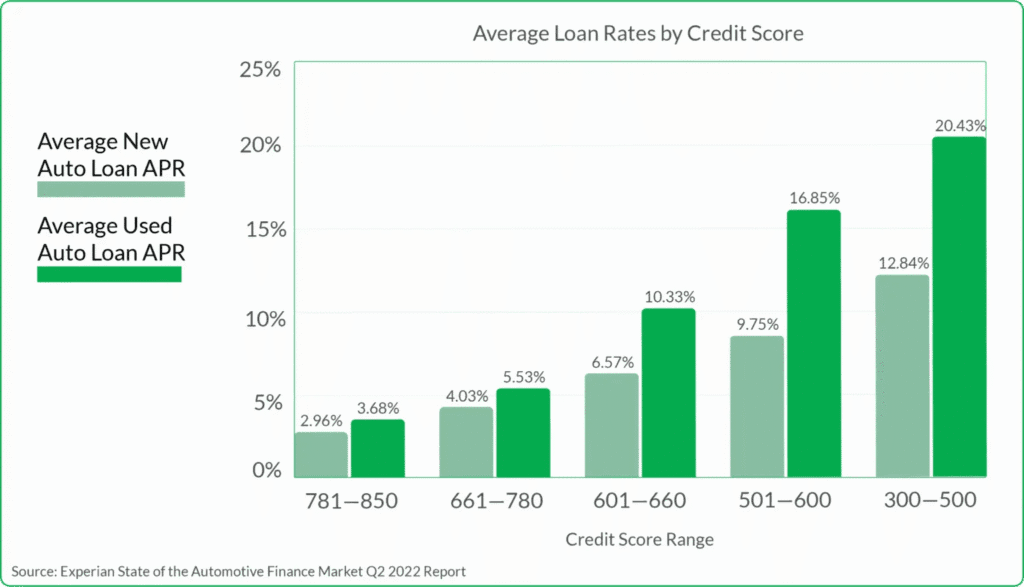

- The Accurate Rate & Term: This is based on an average Annual Percentage Rate (APR) of 6.80% and a term stretched to 68.9 months (Source: Industry Data).

- The Flaw: By forcing the discount onto the Total Deal Price, you reduce the principal amount subjected to that 6.80% interest over 68.9 months, ensuring you minimize interest costs and maximize your long-term savings.

The Strategic Negotiation Checklist: Your Path to Maximum Savings

Walk into the dealership armed with data. Your goal is to secure the manufacturer’s price correction before the market stabilizes.

- Use the Tool First: Use our Post-Credit EV Negotiation Advantage Tool to precisely calculate your price target based on the guaranteed $7,500 manufacturer rebate and inventory data.

- Anchor Low: Your opening offer must reflect the total, manufacturer-backed incentive. Anchor your offer at a price that accounts for both the $7,500 lost credit and the competitive manufacturer rebate.

- Bypass the Payment: Focus the entire discussion on the Total Deal Price. State clearly: “We agree on the final cash price today. Once we agree on the final price, we can discuss financing.”

- Target the Program: Prioritize models from manufacturers who have publicly committed to continuing the $7,500 discount program (e.g., GM, Ford, Hyundai). This minimizes negotiation on the primary incentive.

Post-Credit EV Negotiation Advantage Tool

Determine your optimal discount target now that the federal tax credit is gone.

Your Strategic Target Deal

⚠️ **CRITICAL DISCLOSURE**

The high average monthly payment is a symptom of an industry desperately trying to maintain prices. The end of the $7,500 credit has triggered a manufacturer-led discount war.

The final price of that EV is determined by your knowledge of manufacturer programs and your refusal to negotiate on the monthly payment. Demand the price correction you have earned.

I’ve been driving, testing, and living with electric vehicles for years — from early compact EVs to today’s high-performance models. My journey into e-mobility started out of curiosity but quickly turned into a mission to help others make smarter EV choices. At VeCharged, I break down real-world ownership insights, cost analysis, and charging know-how so you can buy, sell, or switch to an EV with total confidence.