As Europe accelerates its transition to electric mobility, 2025 brings a complex patchwork of incentives, tax breaks, and policy tweaks targeting both individuals and businesses considering electric vehicles (EVs). Understanding these evolving policies is crucial for buyers, fleet owners, and anyone tracking the continent’s green transformation.

Your Estimated Incentive:

Why Incentives Matter

European EV adoption is surging. But sticker price, taxes, and charging infrastructure still determine whether consumers and fleets make the switch. That’s why understanding incentives in your country – and how they differ across borders – can mean thousands of euros saved, quicker payback times, and a vastly better ownership experience. Governments update these incentives yearly (and sometimes quarterly), making the current state of play essential info.

2025 EV Tax Benefits & Incentives: What You Need to Know

1. Acquisition & Registration Tax Breaks

- Austria: Full VAT deduction on BEVs ≤€40,000; incremental deduction up to €80,000. Bonus up to €5,000 for purchasers (split between importer and federal contributions) until May 2025.

- Germany: 10-year vehicle tax exemption for BEVs registered before 2026. Reduced taxation for BEVs and PHEVs as company cars; further reductions for BEVs ≤€70,000.

- France: Registration tax exemptions possible by region. Focused “eco-bonuses” for lower-income buyers and regions. Up to €4,000 new BEV grant; home and shared charging infrastructure heavily subsidized.

- Spain: 15% income tax deduction on acquisition cost, up to €3,000. Major city road tax reductions. Subsidy between €4,500–€7,000 for BEVs with old car scrapping; home charging also tax-deductible.

- Italy: Five-year ownership tax exemption; 75% reduction for BEVs afterwards.

- Belgium (Flanders): €4,000 premium for new BEVs under €40,000, €2,500 for eligible used BEVs over three years old.

- Poland: Up to PLN40,000 grant for new BEVs under PLN225,000.

2. Company Car and Business Benefits

- Luxembourg: Reduced benefit-in-kind tax (0.5–0.6%) for BEVs and FCEVs; €6,000 grant for most efficient BEVs.

- United Kingdom: Preferential benefit-in-kind taxation for zero-emission and ultra-low emission vehicles. Business infrastructure grants supporting EV chargepoints at workplaces.

- Netherlands: VAT deductibility (100%) on BEVs up to €62,500; reduced company income tax for green fleets. Fast depreciation available for EV investments.

3. Charging Infrastructure Grants

- France: The Advenir Programme covers €500-9,000 per installation for home, condo, and public charging points.

- Ireland: Up to €300 grant for home chargers. National infrastructure grants cover up to 70% of public charging installation costs.

- Sweden: “Ladda bilen” grant covers up to 50% of apartment and business charger installation costs.

Country-By-Country Table: EV Incentives in 2025

Below is a comparative snapshot of key policies in select European markets (refer to in-depth government and ACEA sources for current details per country):

| Country | BEV Purchase Grant | Tax Exemption | Company Car Benefit | Charging Support |

|---|---|---|---|---|

| Austria | Up to €5,000 | Yes | Tax break + 15% bonus | Up to €1,800 per wallbox |

| Germany | – | 10 years | Significantly reduced tax | Varies by state |

| France | Up to €4,000 | Yes (region) | Full company car tax exemption | Up to €9,000 public |

| Belgium | €4,000 (Flanders) | Yes | Max deductibility | 15% reduction private, 100% deductible business |

| Spain | €4,500–€7,000 | City-based | 30% tax reduction | 15% installation deduction |

| Italy | – | 5 years | – | Regional |

| Poland | PLN40,000 | Yes | Depreciation benefit | Chargers included |

| UK | – | Yes | Low company car tax | Up to 75% install grant |

Key Trends & Insights

- 2025 marks a year of tightening rules: Many grants are only for private consumers or come with stricter price caps. Company car benefits remain, but emission thresholds and reporting requirements are increasing.

- Charging is a top priority: Most governments allocate direct support for at-home or workplace charger installation, a shift reflecting Europe’s “charging first” approach.

- Taxation is nuanced: Exemptions can apply to VAT, registration, ownership, circulation, and even depreciation. Company car and benefit-in-kind regimes vary wildly, often providing major breaks to both employer and employee.

- Regional variation: Within nations like France, Belgium, and Germany, state/regional schemes provide extra incentives, municipal exemptions, or infrastructure grants.

Staying Up-to-Date

Given that policies shift as budgets, climate targets, and EU rules evolve, stay current by regularly checking:

- The European Automobile Manufacturers Association (ACEA) for updated tables and national fact sheets

- Official government sites for each country

- Latest press releases from automakers and local authorities

- Respected analytics outlets such as JATO, EV-Volumes, SMMT, KBA, and Avere-France

Conclusion

Whether you’re a consumer seeking the best EV deal, a fleet manager planning TCO, or a policymaker benchmarking best practices, Europe’s 2025 landscape offers unprecedented opportunity—if you know where to look. Bookmark this guide and check back often for essential updates on purchase grants, tax breaks, and infrastructure support as the EV era charges forward.

This guide is based on the 2025 ACEA public update and select national government releases as of August 2025.

FAQ: Europe’s Electric Vehicle Incentives & Tax Benefits (2025)

General

Q: What types of incentives are available for electric cars in Europe in 2025?

A: Incentives vary by country and may include purchase grants, VAT/duty exemptions, reduced registration and ownership taxes, benefit-in-kind (company car) tax breaks, and subsidies for home or public charging installation.

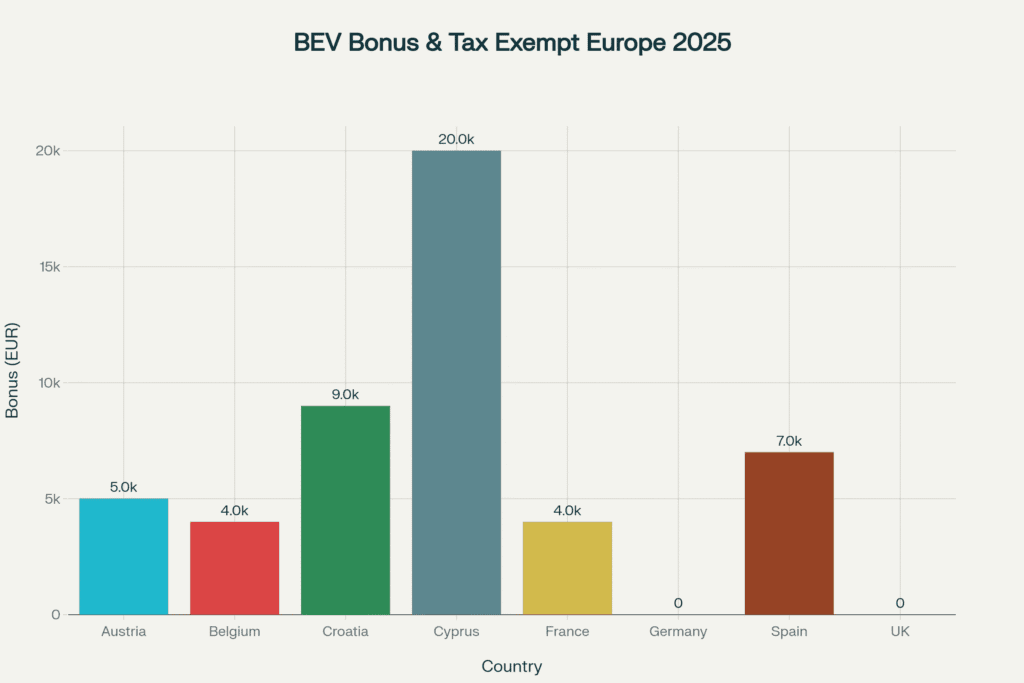

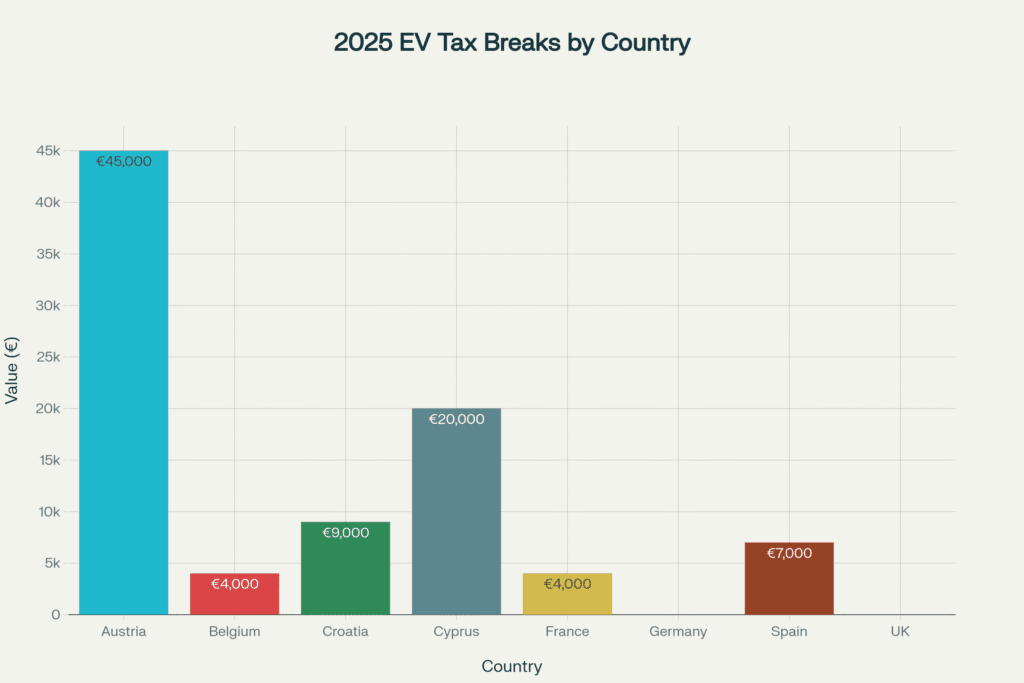

Q: Which European countries offer the highest EV purchase grants in 2025?

A: Cyprus (up to €20,000 for a new zero-emission car), Greece (up to €17,500 for electric taxis), Slovenia (up to €7,200), and Spain (up to €7,000 with scrappage) are among the top.

Country Highlights

Q: What EV incentives are available in Germany in 2025?

A: Germany offers a 10-year vehicle tax exemption for BEVs registered before 2026, reduced company car tax (as low as 0.25% of gross price per month for BEVs ≤€70,000), and state-level charging support.

Q: How much is Austria’s EV purchase bonus in 2025?

A: Austria offers up to €5,000 (€2,000 federal bonus + €3,000 importer bonus) on new BEVs/FCEVs under €60,000 until May 31, 2025. Additional VAT deductions and charging grants up to €1,800 are also available.

Q: What incentives does France offer for electric cars in 2025?

A: France grants up to €4,000 for new BEVs depending on income, regional registration tax exemptions, and Advenir programme grants for charging points (from €500 for home to €9,000 for public).

Q: What tax and purchase benefits exist in Spain in 2025?

A: Spain gives a 15% income tax deduction on EV purchases (max €3,000), road tax reductions in major cities, up to €7,000 in subsidies under MOVES III-type schemes, and 15% deduction for home charger installation.

Q: Does the UK still give EV purchase grants in 2025?

A: The UK no longer offers general EV purchase grants but has targeted incentives (e.g., up to £2,500 for wheelchair-accessible EVs) and extensive charger installation support for homes and workplaces covering up to 75% of costs.

Company Car Benefits

Q: How are electric company cars taxed in Europe in 2025?

A: Many countries apply lower benefit-in-kind rates for BEVs, such as 0% benefit-in-kind for the first €45,000 in Ireland, 0.25–0.5% monthly in Germany, and 0.5% in Luxembourg.

Charging Infrastructure

Q: Which EU countries subsidise EV home charger installation in 2025?

A: Examples include Austria (€600–€1,800), France (€500–€1,600), Ireland (€300), Luxembourg (€700–€1,500), and Sweden (50% cost coverage up to SEK 50,000 for green technology installations).

Trends & Strategy

Q: Are European EV grants being reduced in 2025?

A: Yes. Many countries have tightened income caps, vehicle price limits, and eligibility rules, shifting more support towards charging infrastructure rather than direct vehicle purchase subsidies.

Q: Where can I find official updates on European EV incentives?

A: The European Automobile Manufacturers’ Association (ACEA), national government websites, and automotive industry portals like EV-Volumes, JATO, and Schmidt Automotive Research provide the latest data.

Electric Car Incentives & Tax Benefits by Country (Europe, 2025)

This comprehensive FAQ covers all 27 EU countries, the UK, and EFTA members (Norway, Switzerland, Iceland, Liechtenstein)

Austria

Q: What are Austria’s 2025 electric car incentives?

A: Austria offers up to €5,000 in BEV/FCEV purchase bonuses (until May 31, 2025), full VAT deduction for EVs ≤€40,000, exemption from ownership & pollution taxes, and up to €1,800 grant for charging stations. Zero-emission company cars and workplace charging are tax-exempt.

Belgium

Q: What are Belgium’s EV tax benefits and grants in 2025?

A: Flanders gives €4,000 for new BEVs ≤€40,000 and €2,500 for used, with full tax deductibility and 100% company car expense deductibility. Wallonia and Brussels apply minimum taxes for BEVs/FCEVs. Home charger installation can earn a 15% tax reduction.

Bulgaria

Q: What BEV incentives are available in Bulgaria in 2025?

A: Bulgaria exempts electric vehicles from acquisition and ownership taxes.

Croatia

Q: What purchase grants does Croatia offer for electric cars in 2025?

A: Annual incentive scheme: €9,000 for BEVs, €5,000 for PHEVs (max vehicle price €50,000), plus tax exemption and charging grants for entities. Offers remain while funding lasts through 2025.

Cyprus

Q: How much does Cyprus subsidize new EVs in 2025?

A: Up to €20,000 to buy a new zero-emission vehicle, €15,000 to scrap and replace with an EV, and €9,000 for a used zero-emission car.

Czechia

Q: What support does Czechia give for electric cars in 2025?

A: BEVs enjoy reduced road tolls, are exempt from registration charges, enjoy accelerated depreciation, and companies can get charging infrastructure grants and enhanced depreciation for wallboxes.

Denmark

Q: What are Denmark’s EV incentives for 2025?

A: BEVs/FCEVs pay only 40% of registration tax plus a DKK165,500 deduction. PHEVs see reduced rates. Minimum ownership tax for zero-emission vehicles: DKK420/half-year. No tax on company-provided chargers at employee homes.

Estonia

Q: What EV grant is available in Estonia in 2025?

A: €5,000 for individuals buying or leasing a new BEV, plus registration tax discounts.

Finland

Q: What are Finland’s electric car incentives in 2025?

A: Zero-emission cars are exempt from registration tax, benefit-in-kind income tax deduction of €170/month for BEVs, and workplace charging is not taxed.

France

Q: What EV incentives are there in France in 2025?

A: Up to €4,000 new BEV/FCEV grant (income-based, vehicle ≤€47,000), regional registration tax exemption, Advenir grants (€500–9,000) for charging installations at homes and public sites.

Germany

Q: What tax breaks and grants does Germany give for EVs in 2025?

A: 10-year tax exemption for BEVs/FCEVs registered before 2026, reduced company car tax (0.25%/0.5%/1%), further incentives at state level, and no purchase subsidy for most private buyers.

Greece

Q: What are Greece’s electric car taxes and grants for 2025?

A: Up to €9,000 cashback on BEV purchase, €2,000 bonus for scrappage, 40% bonus for zero-emission taxis (max €17,500), registration and circulation tax exemption, and €500 wallbox grant.

Hungary

Q: What BEV incentives exist in Hungary (2025)?

A: Full tax exemption for BEVs and corporate BEV purchase grants up to €10,500 (with closing in March 2025), plus full tax deductibility for charging investments.

Ireland

Q: What are Ireland’s 2025 electric vehicle incentives?

A: €5,000 relief for BEVs up to €40,000, home charger installation grant of €300, and 0% BIK benefit up to €45,000 for company cars. Infrastructure grants cover up to 70% of charger installation costs.

Italy

Q: What EV tax break applies in Italy for 2025?

A: Five-year exemption from ownership tax for BEVs; 75% reduction afterward.

Latvia

Q: Does Latvia offer EV tax breaks in 2025?

A: Yes, BEVs are exempt from first registration and ownership taxes, with minimum annual tolls.

Lithuania

Q: What grants does Lithuania offer for BEVs in 2025?

A: Up to €5,000 grant for new BEVs, VAT deduction up to €50,000 vehicle price, up to €1,500 for a private wallbox, and up to €3,000 for shared charging.

Luxembourg

Q: What are the Luxembourg EV incentives for 2025?

A: €6,000 purchase bonus for efficient BEVs (lower for higher consumption), €700–1,500 for home charging stations, 0.5%–0.6% BIK company car rate, and €1,500 for used BEVs over three years old.

Malta

Q: What is Malta’s electric car incentive in 2025?

A: Up to €8,000 grant for new BEVs ≤€40,000, reduced grant for costlier vehicles, and up to €1,000 extra for scrappage.

Netherlands

Q: What are EV incentives in the Netherlands for 2025?

A: Minimum registration tax of €667, 100% VAT deduction for BEVs ≤€62,500/company cars, arbitrary depreciation allowed, and infrastructure grants for businesses.

Poland

Q: What is the EV subsidy in Poland for 2025?

A: BEVs/FCEVs are exempt from acquisition and ownership taxes. Individuals and sole traders get PLN18,750–PLN40,000 subsidies for BEVs up to PLN225,000, with depreciation benefits up to the same price limits.

Portugal

Q: Which EV tax incentives are in place in Portugal (2025)?

A: Complete acquisition and ownership tax exemption for BEVs, €3,000 new BEV grant (one per person), VAT deduction for BEVs ≤€62,500, and company car tax reductions for green fleets.

Romania

Q: Does Romania provide incentives for electric cars in 2025?

A: BEVs are exempt from acquisition and ownership taxes.

Slovakia

Q: What EV tax benefits are in Slovakia for 2025?

A: BEVs face a max €33 registration fee, are exempt from road tax, get accelerated depreciation, and charging for company cars at home is a corporate expense.

Slovenia

Q: What BEV subsidies are available in Slovenia in 2025?

A: Up to €7,200 subsidy for new BEVs ≤€35,000, smaller grants for cars up to €65,000, and no benefit-in-kind tax for BEVs as company cars.

Spain

Q: Which electric vehicle incentives does Spain offer in 2025?

A: Up to €7,000 grant for new BEVs (with scrappage, via MOVES III), 15% personal income tax deduction on purchase/charger installation (max €3,000/€4,000), 75% city road tax reduction, and reduced company car taxation.

Sweden

Q: What are the Swedish EV incentives and grants in 2025?

A: Low annual road tax (SEK360) for zero-emission cars, SEK10,000 scrappage premium, SEK50,000 max deduction for home charging, and a 50% “Ladda bilen” grant for apartment/workplace chargers.

Iceland

Q: How much support does Iceland give for new electric cars?

A: €6,000 grant for new BEVs under €67,000, reduced for used models by age, plus very low annual taxes.

Norway

Q: What are Norway’s 2025 electric vehicle incentives?

A: 25% VAT exemption for BEVs up to NOK500,000, road toll and tax reductions, 20% lower company car tax, and some local/municipal charger grants.

Switzerland

Q: What EV support is available in Switzerland (2025)?

A: Various cantons offer temporary acquisition and ownership tax reductions or exemptions for low-emission vehicles. Municipalities support charging station installation costs.

United Kingdom

Q: What EV grants and tax breaks does the UK offer in 2025?

A: Up to £2,500 for wheelchair-accessible BEVs, 10 years circulation tax exemption for BEVs, 0% BIK for zero-emission company cars under certain values, and grants cover up to 75% of home/work charger installation (max £350/socket).

This FAQ is updated as of August 2025 and draws from the ACEA’s official guide to tax benefits and purchase incentives. For detailed eligibility, limits, and the latest policy changes, always check your national government and agency sites.

Suhas Shrikant is the founder of Vecharged and an engineering enthusiast specializing in high-power off-grid solar systems. He has designed and built over a dozen custom systems and uses his hands-on, field-tested experience to create Vecharged’s expert guides and reviews.